Fuel Tax Highway Fund . policymakers have a number of options to increase the resources available in the highway trust fund: the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. Each year, highway users pay billions of dollars. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the taxes dedicated to the htf are extended periodically by congress. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.”

from www.slideserve.com

the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. Each year, highway users pay billions of dollars. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” policymakers have a number of options to increase the resources available in the highway trust fund: the taxes dedicated to the htf are extended periodically by congress.

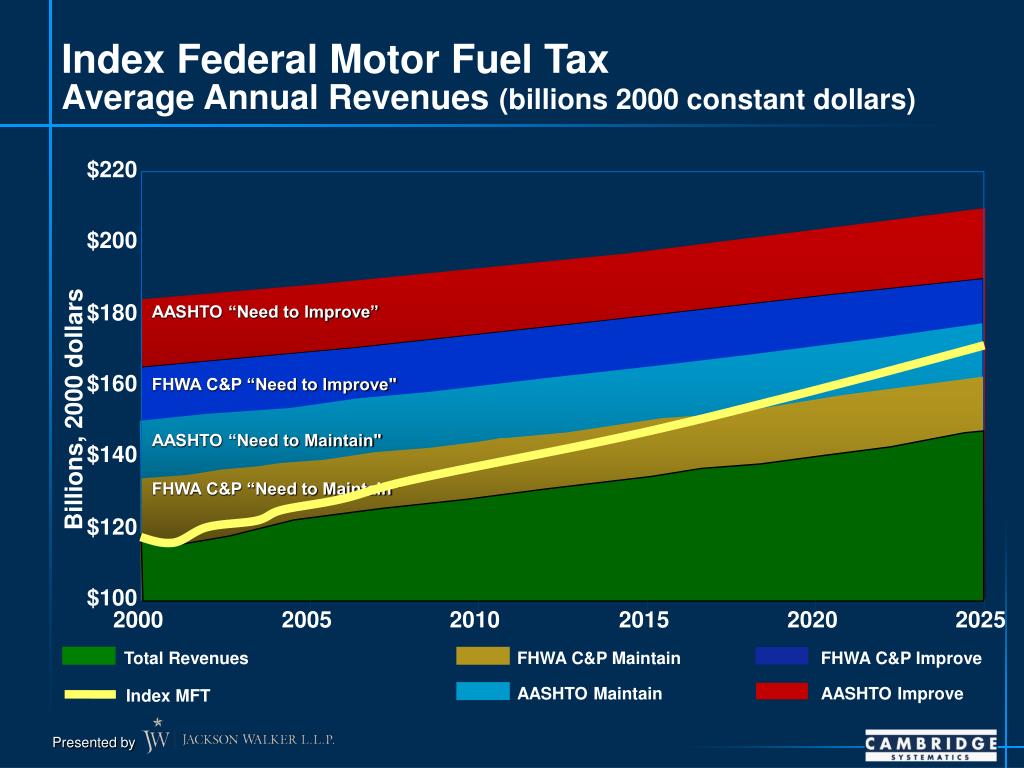

PPT Funding of Highways Crisis and Solutions PowerPoint Presentation

Fuel Tax Highway Fund policymakers have a number of options to increase the resources available in the highway trust fund: the taxes dedicated to the htf are extended periodically by congress. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” policymakers have a number of options to increase the resources available in the highway trust fund: Each year, highway users pay billions of dollars.

From slideplayer.com

Winners and Losers Distributional Impacts of Highway User Fees ppt Fuel Tax Highway Fund 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the congressional budget office (cbo) reports that the highway trust fund received. Fuel Tax Highway Fund.

From studycorgi.com

The US Highway Trust Fund and Federal Fuel Tax Free Essay Example Fuel Tax Highway Fund the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. Each year, highway users pay billions of dollars. the congressional budget office (cbo) reports that the highway. Fuel Tax Highway Fund.

From digital.library.unt.edu

The Federal Excise Tax on Motor Fuels and the Highway Trust Fund Fuel Tax Highway Fund the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” Each year, highway users pay billions of dollars. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4. Fuel Tax Highway Fund.

From taxfoundation.org

Vehicle Miles Traveled (VMT) Tax Highway Funding Tax Foundation Fuel Tax Highway Fund Each year, highway users pay billions of dollars. the taxes dedicated to the htf are extended periodically by congress. policymakers have a number of options to increase the resources available in the highway trust fund: 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel. Fuel Tax Highway Fund.

From www.taxpolicycenter.org

What is the Highway Trust Fund, and how is it financed? Tax Policy Center Fuel Tax Highway Fund the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” policymakers have a number of options to increase the resources available in the highway trust fund: the taxes dedicated to the htf are extended. Fuel Tax Highway Fund.

From www.pgpf.org

Budget Basics More StopandGo Financing of Highway Trust Fund Fuel Tax Highway Fund 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the taxes dedicated to the htf are extended periodically by congress. Each. Fuel Tax Highway Fund.

From www.scribd.com

House Hearing, 110TH Congress Structure of The Federal Fuel Tax and Fuel Tax Highway Fund the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” Each year, highway users pay billions of dollars. policymakers have a number of options to increase the resources available in the highway trust fund: . Fuel Tax Highway Fund.

From www.vox.com

The US highway funding crisis, in 6 charts Vox Fuel Tax Highway Fund the taxes dedicated to the htf are extended periodically by congress. policymakers have a number of options to increase the resources available in the highway trust fund: 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the congressional budget office (cbo) reports. Fuel Tax Highway Fund.

From www.vox.com

The US highway funding crisis, in 6 charts Vox Fuel Tax Highway Fund Each year, highway users pay billions of dollars. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the taxes dedicated to the htf are extended periodically by congress. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and. Fuel Tax Highway Fund.

From taxfoundation.org

Vehicle Miles Traveled (VMT) Tax Highway Funding Tax Foundation Fuel Tax Highway Fund the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” the taxes dedicated to the htf are extended periodically by congress. the taxes on highway motor fuel will continue past september 30, 2022, but. Fuel Tax Highway Fund.

From www.pgpf.org

The Highway Trust Fund Explained Fuel Tax Highway Fund policymakers have a number of options to increase the resources available in the highway trust fund: Each year, highway users pay billions of dollars. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” . Fuel Tax Highway Fund.

From slideplayer.com

21st Century Transportation Committee Finance ppt download Fuel Tax Highway Fund the taxes dedicated to the htf are extended periodically by congress. Each year, highway users pay billions of dollars. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” 52 rows the united states. Fuel Tax Highway Fund.

From www.pewtrusts.org

Funding Challenges in Highway and Transit The Pew Charitable Trusts Fuel Tax Highway Fund the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” Each year, highway. Fuel Tax Highway Fund.

From pgpf.org

The Highway Trust Fund Explained Fuel Tax Highway Fund the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the taxes dedicated to the htf are extended periodically by congress. policymakers have a number of options to increase the resources available in the highway trust fund: the highway trust fund—the major source of. Fuel Tax Highway Fund.

From taxfoundation.org

Federal Highway Fund Taxes & Infrastructure Funding for Highways Fuel Tax Highway Fund the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” the taxes on highway motor fuel will. Fuel Tax Highway Fund.

From www.dailysignal.com

Congress Set to Decide Future of Highway Trust Fund Fuel Tax Highway Fund the taxes dedicated to the htf are extended periodically by congress. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate of 4.3 cents per gallon. the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. Each year, highway users pay billions of. Fuel Tax Highway Fund.

From www.slideserve.com

PPT Form 2290 HVUT Tax Funds Used to Maintain the Highways PowerPoint Fuel Tax Highway Fund the congressional budget office (cbo) reports that the highway trust fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” policymakers have a number of options to increase the resources available in the highway trust fund: 52 rows the united states federal excise tax. Fuel Tax Highway Fund.

From www.miamiherald.com

Gastax hike is best highway fix, key agency says Miami Herald Fuel Tax Highway Fund the highway trust fund—the major source of federal road and bridge funding—is largely supported by gas taxes. 52 rows the united states federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. the taxes on highway motor fuel will continue past september 30, 2022, but at a reduced rate. Fuel Tax Highway Fund.